michigan gas tax increase

The gasoline tax of 19 cents a gallon will increase by 73 cents and the diesel tax of 15 cents a gallon will go up 113 cents with automatic annual inflationary adjustments in. Inflation Factor Value of Increase Percentage.

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

Michigans gas tax is currently 263 cents per gallon for both regular and diesel fuel.

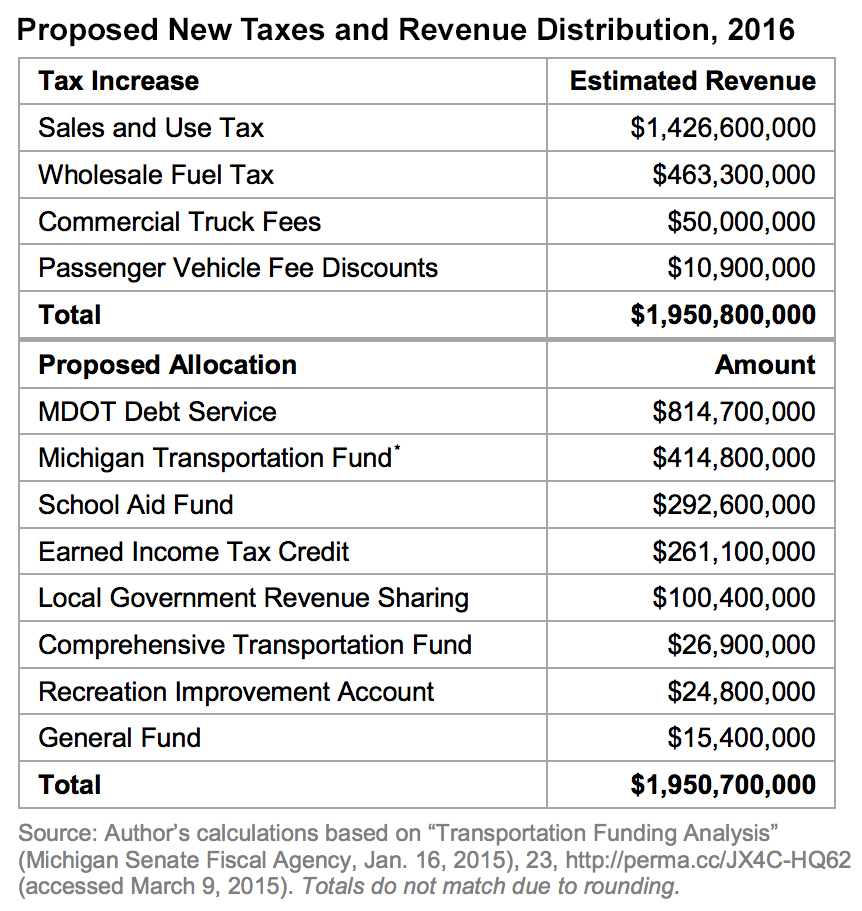

. Gas and Diesel Tax rates are rate local sales tax. 1 2020 and Sept. Rick Snyder has made road funding his top 2013 agenda item and theres been some talk.

The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. The goal Whitmer said. Federal excise tax rates on various motor fuel products are as follows.

Fully half of them however divert a portion of those taxes for other purposes. By Jack Spencer February 2 2013. If 2021 inflation is 5 or more then the fuel tax will be.

Per MCL 2071010 the owner of motor fuel held in bulk storage where motor fuel tax has previously been paid to the supplier at the lower rate would owe the difference between the. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon. Whitmer failed in her push for a 45-cent-per-gallon gas tax increase which the governor claimed would raise an estimated 25 billion.

Is A Michigan Gas Tax Increase Inevitable. The current state gas tax is 263 cents per gallon. Whitmer is bonding for over 35 billion.

July 06 2020 0300 PM. State taxes fuel sales to fund road repairs. The exact amount of the 2022 increase will depend on the inflation that occurs between Oct.

Starting January 1 2017 gas taxes will increase 73 cents and diesel will go up 113 cents. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments. The 45-cent increase would bring Michigans gas tax to.

To increase the state gasoline and diesel taxes to 223 cents per gallon starting Oct. Vehicle registration fees will rise 20 percent. Michigans gas tax is among the highest in the nation as rouhgly 10 of your fill up goes to state and federal taxes.

Included in the deal was a gas tax increase of 73. 0183 per gallon. This chart shows the relative size of historic gasoline tax increases in Michigan Author.

Gretchen Whitmer wants to nearly triple the states gas tax to raise about 2 billion per year for roads. LANSING It took a tie-breaking vote by Lt. The gasoline tax of 19 cents a gallon will increase by 73 cents and the diesel tax of 15 cents a gallon will go up 113 cents.

Whitmers proposed three-step increase over a one-year period would give Michigan the. The current gas and diesel tax rates. Michigan Governor Gretchen Whitmer D this week released her fiscal year FY 2020 budget bill central to which is a 45-cent gas tax increase and a new entity-level tax on.

Michigans Democratic Gov. Brian Calley but the Senate passed a 15-cent hike in the states gas tax to. Michigan Senate passes increase in gas tax.

The increase is capped at 5 even if actual inflation is higher. So far in 2021 inflation has been unusually high. 1 2018 and after that index the amount to inflation.

As Gas Prices Soar Michigan Tax Holiday Plans Prompt Squabbling Gridlock Bridge Michigan

Whitmer Takes Flak For Calling 20 Cent Gas Tax Hike Ridiculous

Resident Information Ottawa County Road Commission Michigan

Michigan S May Tax Proposal Mackinac Center

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Michigan S Gas Tax How Much Is On A Gallon Of Gas

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Michigan Gas Prices Rose 42 Cents In One Week Hitting Highest Peak In Years Mlive Com

Michigan Gas Prices Would Drop 50 Cents Under Senate Approved Summer Tax Cut Mlive Com

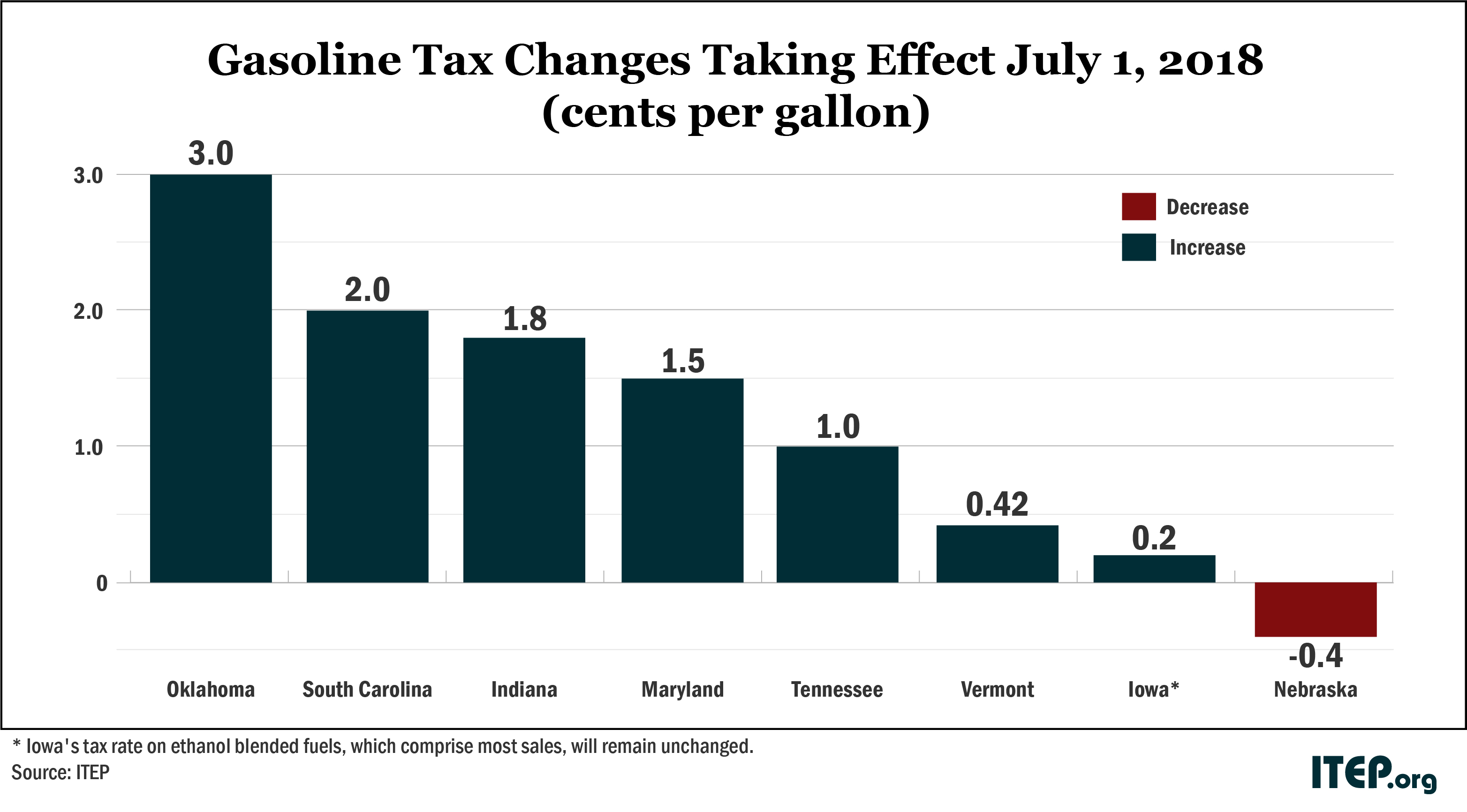

Most States Have Raised Gas Taxes In Recent Years Itep

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

How Long Has It Been Since Your State Raised Its Gas Tax Itep

See How Much A 45 Cent Michigan Gas Tax Might Cost You Bridge Michigan